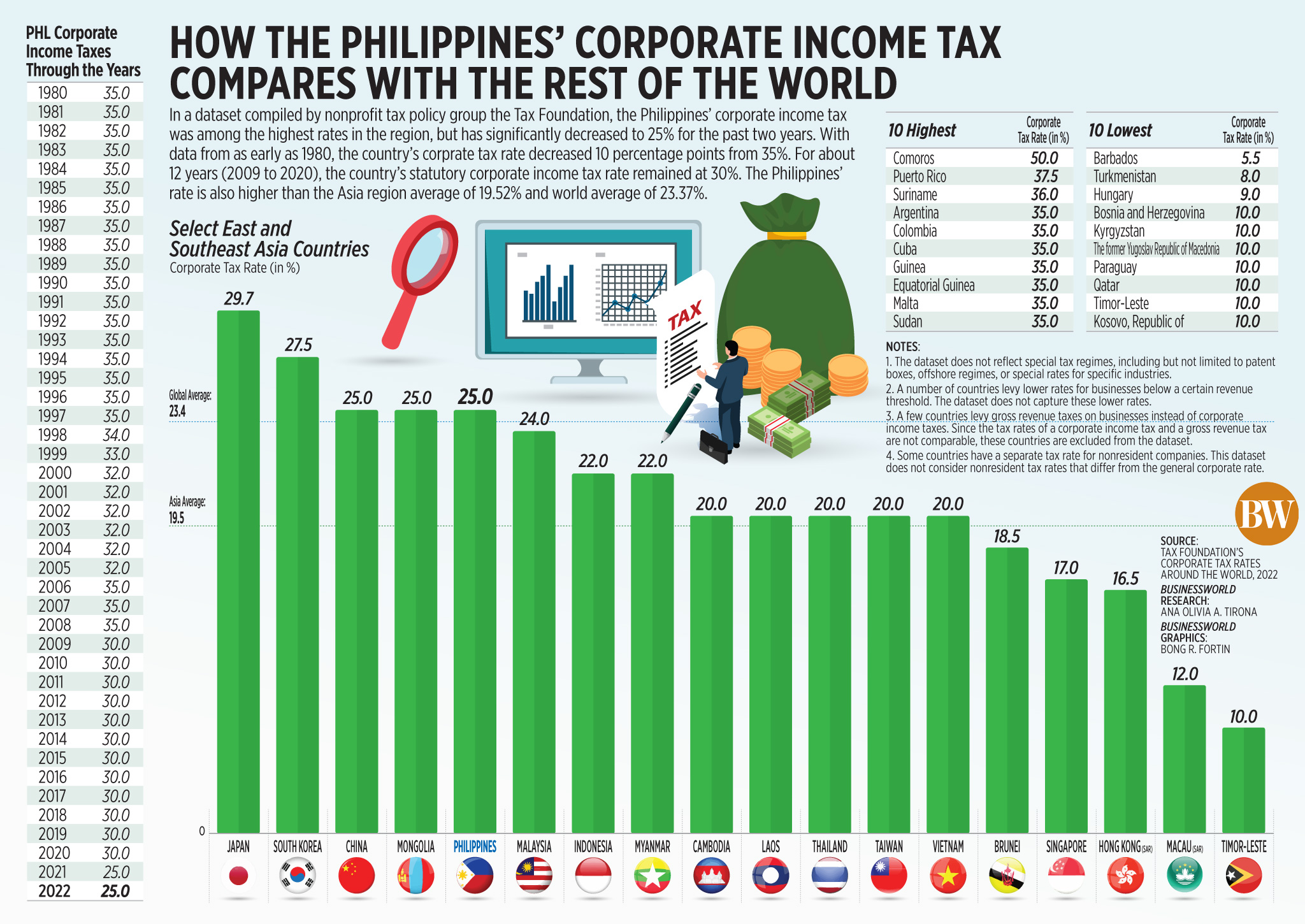

Philippine Corporate Income Tax Rate 2025. Effective from july 1, 2025, philippine corporations are taxed at a rate of 25% (reduced from 30%), except for corporations having net taxable revenue of less than 5 million php and total assets of less. Use our interactive tax rates tool to compare tax rates by country or.

Use our interactive tax rates tool to compare tax rates by country or. 11534 otherwise known as corporate recovery for tax incentives and enterprises (create) act, amending further the tax code of the philippines, has changed, among.

Under the new tax regime, taxpayers with a net taxable income of up to rs 7,00,000 are eligible for a.

2025 Tax Rates Philippines Karee Gertruda, The create law reduces the regular corporate income tax on the net taxable income of domestic corporations and resident foreign corporations (e.g., branch. The corporate income tax rate is 25 percent.

Tax Table 2025 Philippines Anny Tressa, An immediate ban on philippine offshore gaming operators or pogos, underscoring of a bloodless fight against illegal drugs, and a reaffirmation of a. A lower corporate income tax of 20% is also provided for domestic corporations with.

Philippines New Tax Brackets 2025 Jolee Selestina, Philippines corporate tax rate was 25 % in 2025. The income tax due for the taxable year shall be that which.

Capital Gains Tax Rate 2025 Philippines Image to u, In the philippines, corporations face a 25% income tax rate, with certain entities eligible for exemptions or a reduced rate of 20%. If you're operating a domestic.

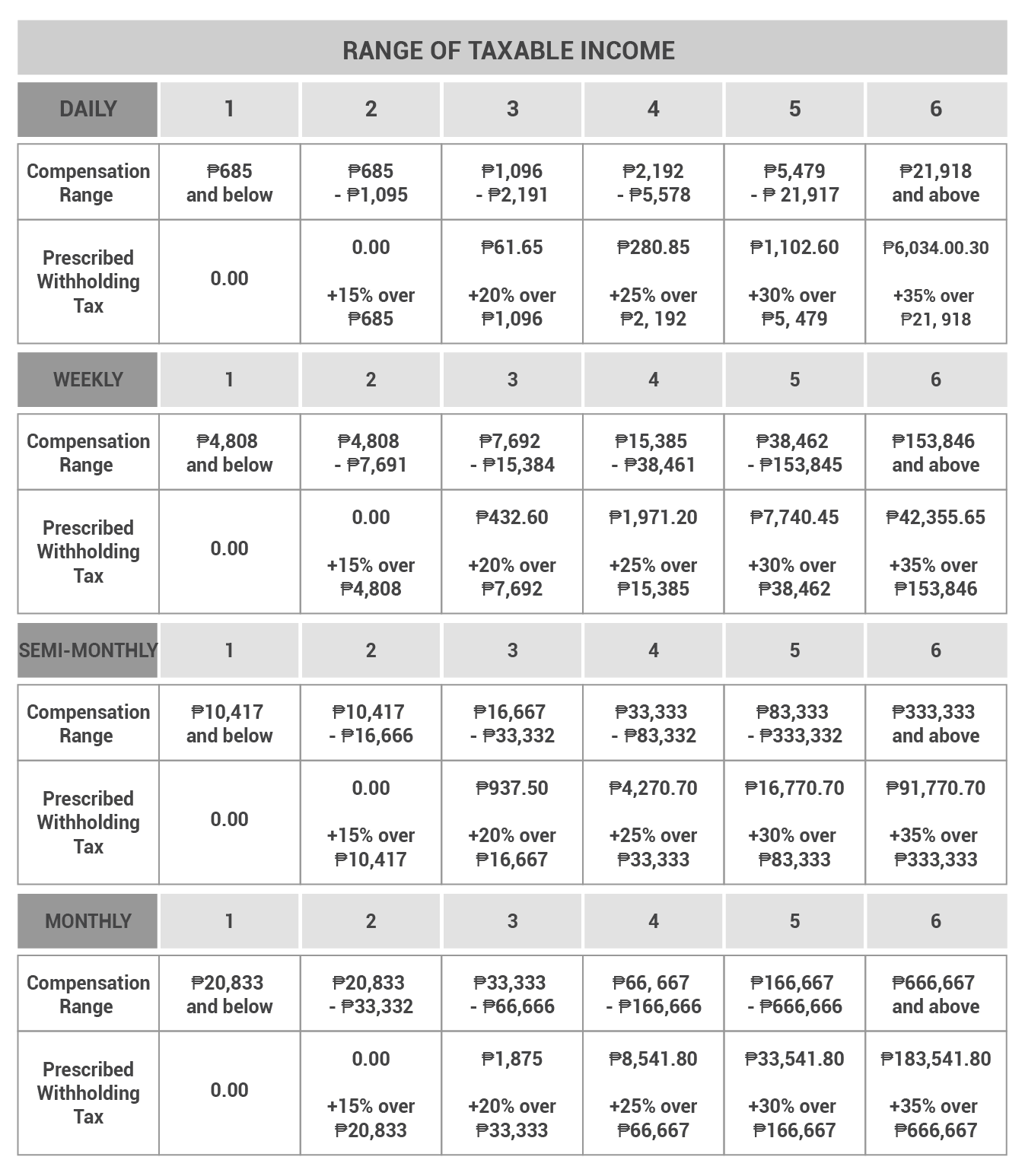

How the Philippines’ corporate tax compares with the rest of the, To compute your income tax in the philippines, you need to know what type of taxpayer you are: Kpmg’s corporate tax table provides a view of corporate tax rates around the world.

Individual Tax Rates 2025 Philippines Image to u, Philippines corporate tax rate was 25 % in 2025. One of the significant reforms under the create act is the lowering of the corporate income tax rate from 30%, previously the highest in asean region, to 20%.

Tax rates for the 2025 year of assessment Just One Lap, Corporate tax rate in philippines is expected to reach 25.00 percent by the end of 2025, according to trading economics global macro models and analysts expectations. Corporate income tax is a tax imposed on the net income or profits of corporations, partnerships, and other entities engaged in trade or business within the.

tax rate philippines 2025 Olin Barone, Because of create law there is a temporary reduction on the rate of minimum corporate income tax from 2% to 1% from july 1, 2025, to june 30, 2025. This tax alert is issued to inform all concerned on the applicable mcit rate for the accounting periods ending from july 31, 2025 to june 30, 2025, pursuant to.

2025 State Corporate Tax Rates & Brackets, If you're operating a domestic. 11534 otherwise known as corporate recovery for tax incentives and enterprises (create) act, amending further the tax code of the philippines, has changed, among.

LOOK 🆕 tax rates for… Department of Finance, Philippines corporate tax rate was 25 % in 2025. Minimum corporate income tax (mcit) is temporarily.

So with its high employability rate, tvet will definitely be instrumental in capacitating our people.”.